Income positive, except for Hotels

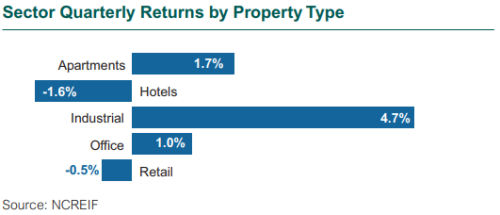

- Hotel and Retail are the most challenged sectors of private real estate, while Office faces uncertainty; Industrial remains the best performer.

- Income remains positive except for the Hotel sector.

NOI declines as Retail suffers

- Net operating income (NOI) declined as Retail continues to suffer.

- 1Q21 rent collections showed relatively stable income throughout the quarter in the Industrial, Apartment, and Office sectors. But the pandemic’s impact on regional malls has hindered Retail.

- Class A/B urban apartments were relatively strong, followed by Industrial and Office.

- Transaction volume has dropped off during the quarter with the exception of multifamily and industrial assets with strong-credit tenants, which are trading at pre-COVID-19 levels.

- Cap rates remained steady during the quarter. The spread between cap rates and 10-year Treasuries is relatively high, leading some market participants to speculate that cap rates will not adjust much.

- Price discovery is happening and there are limited transactions.

Global REITs outpace equities

- Global REITs outperformed in 1Q21, gaining 5.8% compared to 4.9% for global equities (MSCI World).

- U.S. REITs rose 8.9% in 1Q21, beating the S&P 500 Index, which gained 6.2%.

- Globally, REITs are trading above NAV with the exception of those in Hong Kong, the United Kingdom, and continental Europe.

- Property sectors are mixed, between trading at a discount or premium.

- Ongoing volatility in REIT share prices offers opportunities to purchase mispriced securities, individual assets from REIT owners, and discounted debt, as well as to lend to companies and/or execute take-privates of public companies.