Ebullient capital markets are facilitating strong liquidity for private equity, with investors reaping robust distributions and returns. The private equity industry started off 1Q21 well, fueled by stimulus, optimism, and positive investor sentiment toward private equity supported by recent returns. Fundraising, exits (particularly IPOs), and returns were generally up, but new investments declined slightly from the prior quarter. The key negative is that new investment prices remain high, particularly for the Technology sector. If opening up the economy proceeds without major setbacks, 2021 may set new records in volumes and private equity industry growth.

Fundraising: Commitments on the Rise

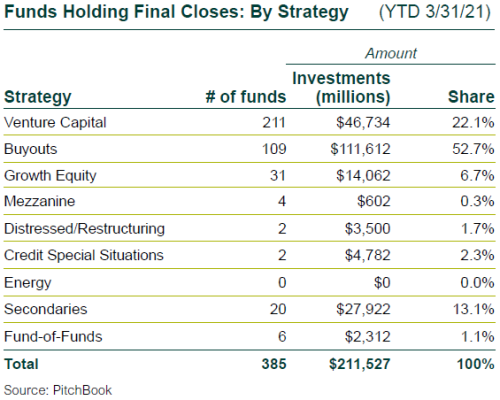

- 1Q21 dollar volume exceeds any quarter in 2020, and is 13% ahead of 1Q20, which was largely unaffected by the pandemic.

- New commitments in 1Q21 to private equity partnerships holding final closes were up 6% from 4Q20, but new partnerships formed dropped 17%.

- Callan expects fundraising to remain vigorous as 2021 advances. General partners are coming back to market quickly with notable increases in fund sizes.

- Venture capital’s 22% share of 1Q21’s commitments is well above its long-term low-teens norm.

- Commitments took a decided U.S. tilt in 1Q (72% of global commitments versus 64% in all of 2020).

Buyout Investments: No Big Deal

- New buyout transactions fell, with a 15% dip in count and a 44% plunge in dollar value from 4Q20.

- The lack of any notably large investments explains the quarter’s announced dollar value decline. The biggest investment was the $4.3 billion carve-out of BlueTriton Brands, Nestle’s bottled water division, by One Rock and Metropoulos & Co.

- The good news is that the deal count was slightly higher than 2019’s pre-pandemic average of 2,411 per quarter.

- With the weight of larger funds and the mid-2020 investment slowdown, general partners will be seeking to step-up future deployment.

- According to PitchBook data, average buyout pricing in the first quarter moderated further, which should spur transactions.

- However, average pricing remains above 11x EBITDA, which has been the “new normal” for the last five years or so.

- As the economy seems to be recovering, at least in the U.S., the use of leverage in new transactions became more liberal based on 1Q’s somewhat anecdotal sampling.

VC Investments: Big Increase

- 1Q21’s investment pace vaulted upward with investors’ continued bullishness with Technology, Health Care, and Consumer Products/Services, with those sectors representing 80% of the quarter’s disbursements. Median prices continued to increase across all stages of investment.

- New investments in venture capital companies were up 19%, with announced value jumping 41%.

- The largest investment was a $3.4 billion 10th round in online brokerage Robinhood by a syndicate of 13 investors, including Sequoia, NEA, and Andreessen.

- Unicorn financings jumped to 114 in 1Q from 72 in 4Q and totaled 27% of 1Q’s total dollar volume.

PE-Backed M&A Exits: Respectable, not Vigorous

- 1Q was respectable albeit not vigorous. The number of sales held steady at a good level, but (as with buyout investments) the lack of any large exits dampened dollar volumes.

- Private M&A exits of private equity-backed companies dropped 7%, and disclosed value declined 13%.

- The largest deal was the sale of Refinitiv by Blackstone to the London Stock Exchange Group.

PE-Backed IPOs: Upward Trend Continues

- The continued public equity rally, particularly in small cap, helped the IPO market remain active.

- Private equity-backed IPOs in 1Q were up 32%, with the aggregate dollars raised up 8%.

- Somewhat surprisingly, none of the three largest IPOs were in the typical high-flying sectors.

Venture-Backed M&A Exits: A Slowdown, but Should Pick Up

- Steady exit counts with much diminished dollar volume were encountered in the venture-backed M&A exits area.

- The number of private sales declined 8% from 4Q, and announced value fell 61%.

- The Health Care sector and the semiconductor industry saw the largest transactions.

Venture-Backed IPOs: Another Bell Ringer

- 1Q hosted the strongest quarter seen in some time.

- The number of VC-backed IPOs was up 24%, and the combined float vaulted 50%.

- The three largest IPOs occurred outside the U.S., in China, South Korea, and Europe, focused in the social media and internet commerce industries.

Returns: Great Finish

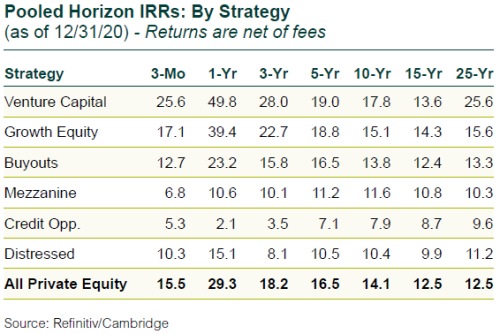

- U.S. public markets rose during both 4Q and in calendar 2020. Private equity returns bested public equity in both periods.

- Periodic volatility in the public equity market’s rise—particularly September and March—aided private equity’s outperformance.

- On a public market equivalent (PME) basis, the Refinitiv/Cambridge private equity database outperformed broad public equity indices over all horizons albeit with narrow margins over 5 years and 10 years.

- Over those two horizons the asset classes have been trading lead positions for some time now depending on the most recent quarter’s return dynamics. If increased market volatility persists for public equity, the relative gains for private equity should widen.