Emboldened by more injections of vaccines, central bank liquidity, and fiscal stimulus in 1Q21, investors’ risk appetites grew again. The leading market beneficiaries were U.S. equities, commodities, and poorly rated credits. Growing fears of inflation stemming from a stronger-than-expected economic outlook caused some violent side effects elsewhere. Risk assets relying on benign interest rate assumptions, like growth stocks, longer-dated bonds, and gold, suffered indigestion from the prior year’s strong advance.

Below the surface of these capital markets, shifting economic currents created notable turbulence within the hedge fund community, including the GameStop saga and the massive losses suffered by Archegos, a family office run by a former hedge fund trader.

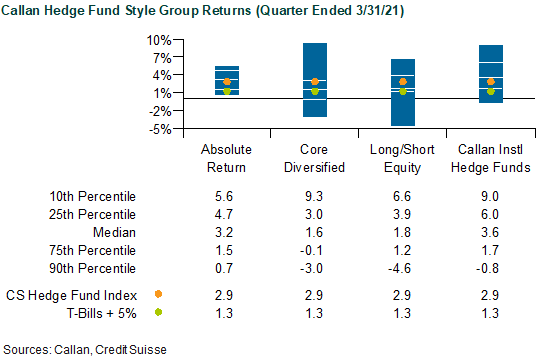

Looking past these distracting headlines, 1Q was broadly good, or at least benign, for hedge funds. Illustrating hedge fund performance without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) gained 2.9%. In the past year following the COVID-stricken 1Q20, the CS HFI has jumped 20.2%. As a proxy for live hedge fund portfolios, net of all fees, the median fund in the Callan Hedge Fund-of-Funds Database Group earned 2.1% in 1Q. Over the last year, the median rebounded 27.1%.

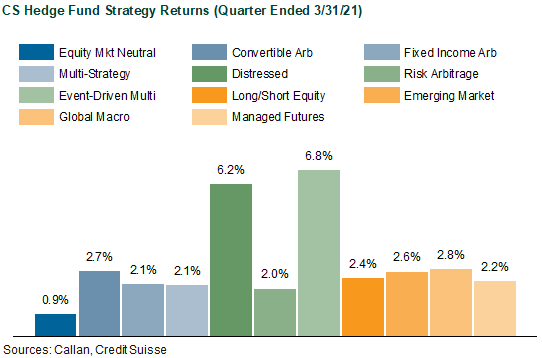

During 1Q21, all of CS HFI’s underlying strategies added value. The best-performing was Event-Driven Multi-Strategy (+6.8%), aided by unusually strong IPO issuance, including SPACs, as well as resilient M&A activity. In the last year, the strategy gained 40.6%, again benefiting from the rich environment of corporate activities fueled by economic stimulus. Strategies hedged against equity and rate risks yielded modest, however less stressful, profits, such as Convertible Arb (+2.7%), Fixed Income Arb (+2.1%), and Risk Arb (+2.0%).

Representing 50 large, broadly diversified hedge funds with low-beta exposure to equity markets, the average Callan Institutional Hedge Fund (CIHF) manager earned 4.1%, net of fees. Within this peer group, the average Hedged Credit fund gained 6.1% while the average Hedged Cross-Asset fund advanced 3.7%. With minimal net equity exposure, the average Hedged Equity fund yielded 2.2%. The weakest subpeer group was Hedged Rates (+1.5%).

Within the Callan Hedge Fund-of-Funds Database Group, market exposures did not notably differentiate a hedge fund portfolio’s performance in 1Q. Despite a strong U.S. equity rally, the median Callan Long/Short Equity FOF (+1.8%) lagged the Callan Absolute Return FOF (+3.2%), which benefited more from corporate events and recovering credits. With diversifying exposures to both non-directional and directional styles, the Core Diversified FOF netted 1.6%.

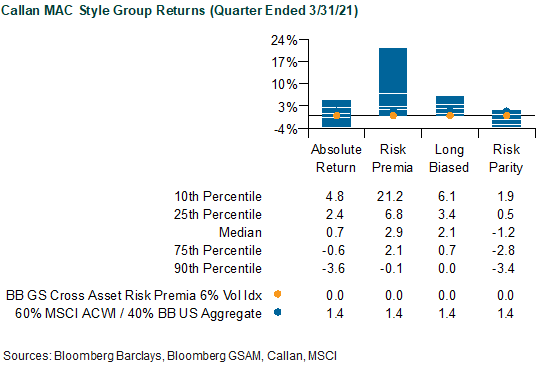

Measuring the performance of alternative betas in 1Q, the Bloomberg GSAM Risk Premia Index was flat (+0.0%) based upon a 6% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, the biggest winner was U.S. Equity Value Long/Short (+8.4%), illustrating the degree that value regained investor interest when rising rates discount future growth. Given the quarter’s violent inflection point of style factor reversals, U.S. Equity Momentum Long/Short lost 6.4% and was the lowest-returning strategy.

Within Callan’s database of liquid alternative solutions, three of the four Multi-Asset Class (MAC) Style Groups generated positive returns, gross of fees, consistent with their underlying risk exposures. The median Callan Risk Premia MAC rose 2.9%, aided by the rebounding value factor. Given a usually long equity bias within its dynamic asset allocation mandate, the Callan Long-Biased MAC (+2.1%) marginally outperformed the traditional benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index (+1.4%). Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC lost 1.2%, given its outsized dollar weight to bonds. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC edged ahead 0.7%.

Given the quarter’s emerging risks of rising inflation and overheating economies, traditional betas will likely face headwinds. However, the outlook for hedge funds and alternative betas remains attractive, with healthy trading and diverging secular forces creating profitable opportunities not dependent on beta. As economies follow different paths of recovery, greater expected volatility across and within capital markets may also create more profitable opportunities for risk allocators embodied in hedge funds and other liquid alternatives. In such a market setting, strategies of macro, relative value, and event-driven trades are well positioned to play a diversifying role for the traditional long-only institutional investor facing challenging scenarios for both stocks and bonds.