This blog post from Callan’s Private Equity Consulting Group provides a high-level summary of private equity activity through all the investment stages, from fundraising to exits, as well as performance data across a range of market cycles. (Investment-stage data provided by PitchBook; performance data from Refinitiv/Cambridge.)

Fundraising: It’s Another Story Now

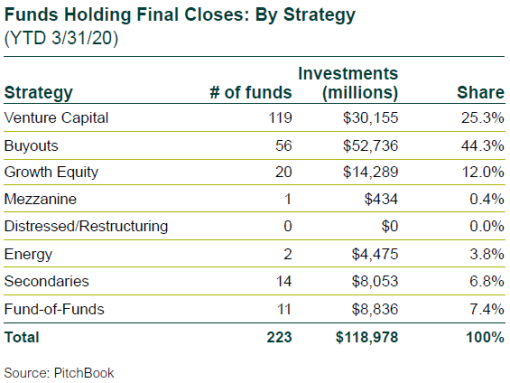

- Fundraising took a steep drop in the first quarter, amid volatile public markets. Funds closing fell 39% from the prior quarter, while commitments were down 37%.

- Fundraising is expected to continue to slow in 2020 due to delays caused by slower deployment rates of existing funds.

- The “denominator effect” of institutional investors becoming over-allocated to private equity due to declines in total portfolio values has not—so far—been a significant influence.

- Buyout funds fell to 44% of commitments, compared to 55% in 2019.

- Venture capital started strong with a 25% commitment share, up from 11% for last year.

- Mezzanine and distressed funds had a particularly weak quarter.

- Energy, fund-of-funds, and secondary funds stayed steady at their long-term averages.

- In the first quarter, U.S./North American funds received 74% of global commitments, with Europe at 13%, Asia at 11%, and other regions at 2%.

Buyout Investments: Price Discovery and Cautious Lenders

- Buyouts declined notably, albeit from relatively high levels as general partners are focusing more on existing portfolio company health and less on starting new company platforms.

- Lack of visibility on the future levels and timing of revenue and earnings has created significant price uncertainty, so most sellers and buyer are not finding mutual ground.

- Transactions fell 20% from the prior quarter and dollar volume plunged 44%.

- While public equity markets have rebounded after their peak-to-trough declines of about 30%, it is still too early to have clarity on the overall economic toll that will result from social-distancing protocols.

Prices Inch Down but Stay High

- First quarter prices softened marginally. Average buyout prices were 11.2x EBITDA, down slightly from 11.4x EBITDA in 2019.

- The transactions that closed in 1Q were largely deals-in-process prior to when the COVID-19 shutdowns began.

- While prices fell, general partners put in more equity; the average contribution hit 5.9x, up 0.3x. Debt declined by 0.6x with the average stack in the 5.3x range.

Venture Capital Investments: Less Reactive

- Venture capital (VC) investments also dropped, but not as steeply as buyouts. The number of rounds of financings in the first quarter dropped by 16% while announced dollars fell only 2%.

- Large transactions still dominate with 32 financings of unicorns (VC companies with valuations of over $1 billion) in the first quarter totaling $16 billion.

- Median venture prices for Series A through C continued to increase, but the median late-stage Series D round fell by 20%—the first decline since 2016.

- Information Technology and Consumer Products and Services were the top categories by sector, with Health Care a close third.

Private Equity-Backed M&A Exits: Rapid Deceleration

- Similar to investment activity, closed deals were largely those in process prior to the market downturn.

- Exit count fell by 19% and announced value plunged 69%.

Private Equity-Backed M&A IPOs: Window Open for Just Six Weeks

- Only 11 private equity-backed IPOs occurred in the first quarter, off 67% from 33 in the fourth quarter.

- The total float fell only 14% to $6 billion.

Venture-Backed M&A Exits: OK for Now

- Similar to new venture capital investments, the exits count dipped, but announced dollar volume remained healthy.

- Venture-backed M&A exits by count were down 12%, with no change in announced value.

Venture-Backed IPOs: Limited Time Offer

- Volume suffered from the short 1Q window of stable pricing. While public markets have recovered, confidence in smaller, newer companies will likely be low in the next several quarters.

- The number of venture-backed IPO exits slowed in the first quarter, off by 34%, but the combined new issuance was down only 14% from the prior quarter.

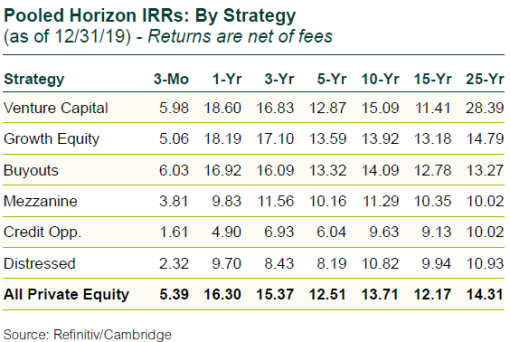

Returns: Public Equity Jumps, but PE Still Outperforms in Long Term

- U.S. public markets rocketed up in the fourth quarter, producing a one-year return in excess of 31%. Private equity’s gain was about half of public equity for the quarter and year.

- On a public market equivalent (PME) basis, for all horizons past one year, the Refinitiv/Cambridge private equity database matched or outperformed broad public equity indices.

- Volatility has been growing in recent years and public and private equity have been playing cat and mouse for near-term periods. While private equity tends to lag steep upward public stock returns, it has been very beneficial in drawdown periods—arguably when support is needed most.

- Even with a moderate fourth quarter, private equity maintains consistent double-digit internal rates of return (IRR) across all the standard investment horizons of one year or longer, and has been competitive with public equity through the public market’s remarkable 10-year rise.