Crushing fragile hopes of continuing economic strength coming into 2020, the COVID-19 pandemic coupled with a sudden oil market collapse forced investors to recalibrate their measures of risk across all capital markets. As investors ran for safe havens, Treasuries soared while equities cratered. Dusting off its playbook from the Global Financial Crisis, the Federal Reserve quickly dropped its short-term rate to near-zero and launched an aggressive quantitative easing program to restore liquidity in investment grade fixed income markets. To further facilitate credit and consumer spending, the U.S. government hastily enacted massive fiscal stimulus.

Markets partially recovered losses by quarter-end. Partially. The S&P 500 fell 19.6%, and riskier markets like MSCI Emerging Markets (-23.6%) and Russell 2000 (-30.6%) nosedived even more. The Bloomberg Corporate High Yield Index crumbled 20.5%. The Bloomberg Commodity Index lost almost a quarter of its value while gold strengthened 5%.

Most Hedge Funds Suffered Notable Losses

Amid this market meltdown, how did hedge funds react? In recent years, they had complained that central banks were constraining market volatility, leaving few mispricings for generating alpha. Be careful what you wish for, eh? Last quarter’s events dramatically changed that sense of carefully curated markets. Because trading in most markets dried up amid this new paradigm of uncertainty, over-extended participants were forced to de-risk. Those hedge funds more defensively positioned only nibbled on the margin, waiting for more clarity on the global economy’s future path.

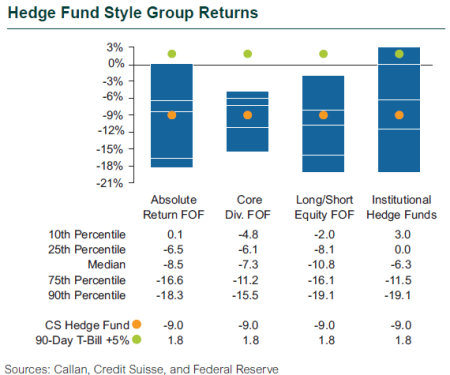

Although some hedge funds enjoyed net gains from their short positions and macro hedges, most suffered notable losses, primarily due to unrealized mark-to-market valuations. Representing a portfolio of hedge fund interests without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) lost 9.0% in the first quarter. As a proxy for live hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Peer Group slumped 8.1%, net of all fees and expenses.

Representing 50 of the largest, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund Peer Group fell 6.3%. Those funds focused on market neutral equity or rates arbitrage ended the quarter flat or modestly positive, whereas those more exposed to corporate credit or structured credit suffered double-digit losses. Those with multiple or cross-asset hedging strategies performed, more or less, in line with the broad group’s average.

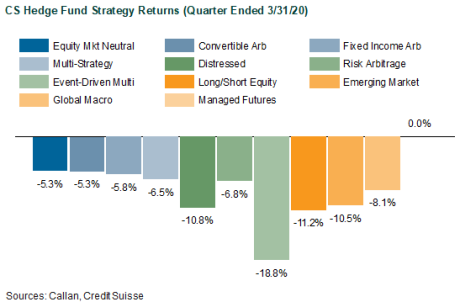

Within CS HFI, the worst-performing index was Event-Driven Multi-Strategy (-18.8%), reflecting its material exposure to soft deals particularly vulnerable to shifting market sentiments and crowded trades. The next group of poorly performing strategies included Long/Short Equity (-11.2%), Distressed (-10.8%), and Emerging Markets (-10.5%). Though also exposed to systematic market risks, Risk Arbitrage recovered much of its mid-quarter loss—due to merger deal spreads blowing out—to finish down “only” 6.8%. Despite low net exposures, risk-on arbitrage strategies like Equity Market Neutral (-5.3%), Convertible Arbitrage (-5.3%), and Fixed Income Arbitrage (-5.8%) suffered the next level of losses due to widened spreads from derisking or being net long with illiquidity. The best-performing strategy last quarter was Managed Futures (+0.0%) where gains from renewed trends in rates and commodities offset losses from the violent reversal of equity trends.

Within the Callan Hedge FOF Group, net exposures to illiquidity and equity-related risks primarily determined performance in the first quarter. The median Callan Long/Short Equity FOF dropped 10.8%, with its net equity exposure driving the loss. Similarly, the median Callan Absolute Return FOF sank 8.5%, albeit amid a wide range of peer returns reflecting their differing degrees of illiquid credit exposure, especially structured credit. With more diversifying exposures to trend and other macro strategies, the Core Diversified FOF (-7.3%) suffered the least of the FOF style groups.

All Callan MAC Style Groups Were Negative

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Measuring the performance of these alternative risk premia in the first quarter, the Eurekahedge Multi-Factor Risk Premia Index dropped 7.0% based upon a 5% volatility target. Within HFR’s family of Bank Systematic Risk Premia Indices, Equity Carry (-46.3%) and Equity Momentum (-35.8%) bore the brunt of factor-based losses, given a sharp market reversal where future dividends became highly suspect. Risk premia in commodity, currency, and rate markets were mostly positive.

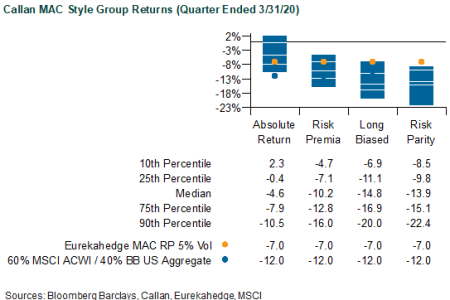

Within Callan’s database of liquid alternative solutions, the median managers of Callan Multi-Asset Class (MAC) style groups were all negative, gross of fees, illustrating the broad punishment of a severe risk-off environment. Targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC fell 13.9%, trailing its benchmark of 60% MSCI ACWI/40% Bloomberg Barclays US Aggregate Bond Index (-12.0%). Given a usually long equity bias within its dynamic asset allocation mandate, the Callan Long-Biased MAC (-14.8%) also trailed the 60%/40% benchmark.

Targeting alternative betas without being explicitly long equities, the median Callan Risk Premia MAC still dropped 10.2% as managers reduced gross exposures to their factors to keep within volatility targets, causing risk premia spreads to widen. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC slipped 4.6%.

Looking ahead with capital markets struggling to repair themselves, hedge funds and alternative betas now have plenty of “alpha” opportunity. As liquidity providers with more patient capital, hedge funds are better positioned to selectively pick oversold values while shorting those less likely to survive the economic blows ahead. While flattened short-term rates ahead have removed any returns from discretionary cash and margin account collateral, greater uncertainty in capital markets has increased the chances for better entry and exit points for the disciplined trader with solid risk management experience. In such a market setting, strategies of macro, relative value, and event-driven trades are well positioned to play a diversifying role for the traditional long-only investor facing muted return outlooks for both stocks and bonds.