At the end of last year, the Federal Reserve quickly pivoted from its longstanding tightening narrative to a pause. With the U.S. economy still strong but slowing, the Fed said it needed “some time” to decide whether to raise or lower rates next.

For most capital markets, that pause was indeed refreshing, as an old Coke slogan put it, setting off a clarion call to buy in the first quarter. Signs of constructive trade negotiations between the U.S. and China also reduced trade war fears hanging over the global economy. Although Europe seemed moribund with Brexit remaining unresolved, Italy’s economy slipping, and German production softening, China’s latest credit surge excited Asian hopes of another growth spurt.

Encouraged by these new developments, investor sentiment reversed from the prior quarter’s depressed mood to newfound confidence, leading to very beta-driven markets particularly within the U.S. Aggressive corporate buyback programs were a significant contributing factor to push U.S. equities higher. Small cap stocks led the rebound, as evidenced by Russell 2000 (+14.6%). The S&P 500’s 13.6% gain was its best quarterly result since the third quarter of 2009. MSCI World ex USA followed behind with a 10.4% advance. Credit spreads also tightened, especially among lower-grade credits, as illustrated by Bloomberg Barclays Corporate High Yield’s 7.3% leap. The Bloomberg Commodity Index jumped 5.7%, thanks to oil prices rebounding over 30% to reverse their fourth quarter losses. Even safe haven assets appreciated, as the FTSE 10-Year Treasury Index rose 3.1% and S&P Gold Spot edged 1.3% higher.

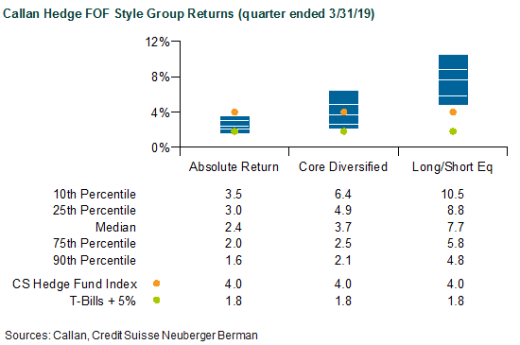

For active management, the first quarter’s fast-moving markets were difficult to handle. Defensive positioning caught hedge funds flat-footed, but most strategies recovered their prior quarter’s losses. Representing raw hedge fund performance without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) rose 4.0% in the first quarter. As a proxy for live hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database advanced 3.6%, net of all fees and expenses.

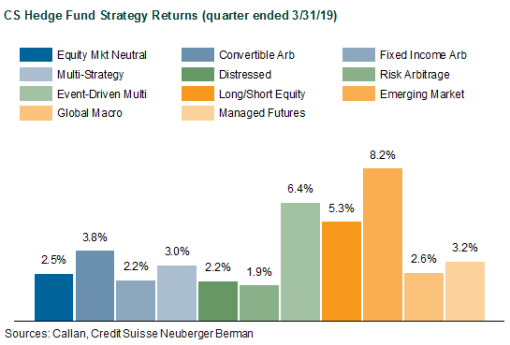

Within CS HFI, Emerging Markets (+8.2%) was the quarter’s best performer, as it recovered most of its losses from the prior three quarters. Event-Driven Multi (+6.4%) was also a strong performer last quarter when soft catalyst-driven stocks bounced back quickly with the renewed risk appetite. In the fourth quarter, this strategy was the worst performer with a 7.7% loss. Also benefiting from the equity market rebound, Long/Short Equity (+5.3%) recovered most of its losses from the prior quarter. However, this peer group average suffered from negative alpha due to poor market timing calls when equity indices rebounded faster than expected.

Strategies with less directional exposure, such as Convertible Arb (+3.8%), Fixed Income Arb (+2.2%), and Equity Market Neutral (+2.5%) yielded moderate gains but had lower losses from the prior quarter to recover. Event-driven strategies with a more hedged or value-based approach, like Risk Arb (+1.9%) and Distressed (+2.2%), also experienced modest gains.

Within Callan’s Hedge Fund-of-Funds Database, market exposures materially affected performance in the first quarter. Aided by the stock market rally, the median Callan Long/Short Equity FOF (+7.7%) handily beat the Callan Absolute Return FOF (+2.4%). With more broadly diversified exposures to hedge fund strategies, the Core Diversified FOF gained 3.7%.

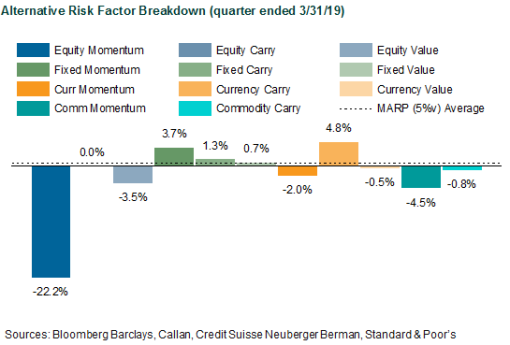

Since the financial crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Measuring the performance of these alternative risk premia in the first quarter, the Credit Suisse Neuberger Berman Multi-Asset Risk Premia Index gained 0.6% based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based premia that are equally risk-weighted, the quarter’s two major contributing factors were Fixed Income Momentum (+3.7%) and Currency Carry (+4.8%). The biggest detractors last quarter were Equity Momentum (-22.2%) and Commodity Momentum (-4.5%), primarily due to the rapid reversals of stock and oil prices at the quarter’s beginning. Also weighing down the broad risk premia index was Equity Value (-3.5%), as growth stocks regained favor.

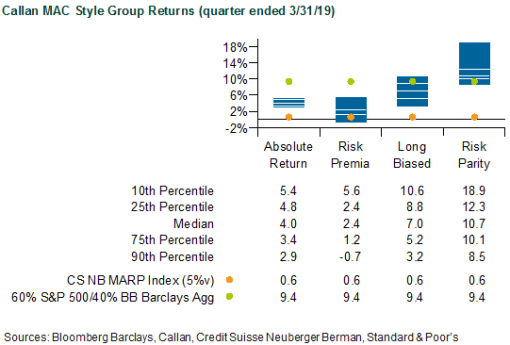

Within Callan’s database of liquid alternative solutions, the median managers in the Callan Multi-Asset Class (MAC) Style Groups showed positive but widely diverging results. The average Callan Risk Parity MAC jumped 10.7%, beating an unlevered benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays Global Aggregate Bond Index that yielded 8.2%. Using little or no leverage, Callan Long-Biased MAC gained 7.0%. With little or no market exposure, the Callan Absolute Return MAC climbed 4% while the Callan Risk Premia MAC only gained 2.4%.