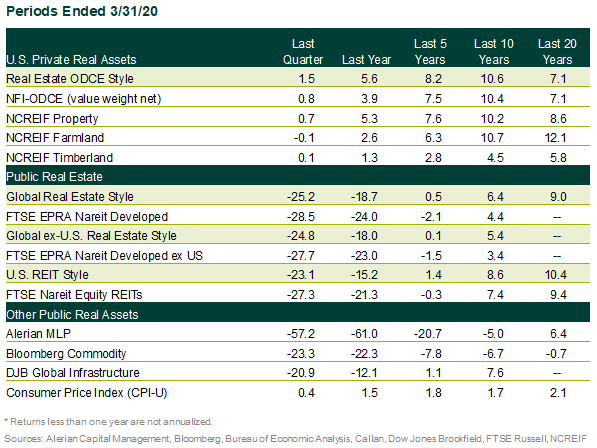

Private real estate results positive due to income

- Initial impact of pandemic reflected in 1Q20 results

- Positive return due to income

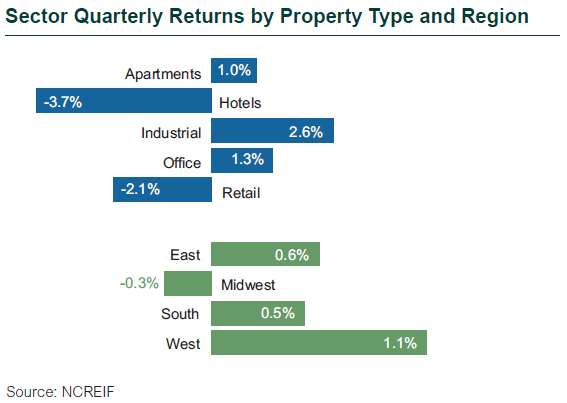

- Industrial real estate performed well.

- Retail depreciation accelerated this quarter.

- The dispersion of returns by manager within the NCREIF ODCE Index was due not only to the composition of underlying portfolios but also valuation methodologies and approaches.

- Negative returns expected for the second quarter and beyond.

How the pandemic is affecting fundamentals

- Vacancy rates for all property types in the U.S. are or will be impacted.

- There has been limited change in net operating income, but the second quarter will show declines.

- April rent collections show severe impact on malls, followed by other types of retail. Class A/B urban apartments are relatively strong, followed by certain types of industrial and office.

- Supply was in check prior to the pandemic.

- Construction is limited to finishing up existing projects but has been hampered by shelter-in-place orders and material shortages.

- New construction will be basically halted in future quarters except for pre-leased properties.

- Transaction volumes were healthy in the first part of the quarter, but dropped off at quarter end and ground to a halt thereafter, with deals being canceled even when there were material non-refundable deposits.

- Cap rates remained steady during the quarter. The spread between cap rates and 10-year Treasuries is relatively high, leading some market participants to speculate that cap rates will not adjust much. Price discovery is happening and there are limited transactions.

- Callan believes the pandemic may cause a permanent re-pricing of risk across property types. Property types with more reliable cash flows will experience less of a change in cap rates; however, those with less reliable cash flows will see greater adjustments

Global REITs underperformed compared to equities and bonds

- Global REITs plunged 28.5% in 1Q20 compared to a 21% drop for global equities (MSCI World).

- U.S. REITs fell 27.3% in 1Q20, lagging the S&P 500 Index, which was off 19.6%.

- Globally REITs are trading at a significant discount to NAV; in most regions the discount is at a five-year low.

- All property types except for data centers, cell towers, and life sciences are trading at the bottom of their range.

Infrastructure sees near-record fundraising

- 1Q20 was the third-largest quarter for closed-end infrastructure fundraising. The closed-end fund market continues to expand, with infrastructure debt, emerging markets, and sector-specific strategies (e.g., communications and renewables). Investor interest in mezzanine or debt-focused funds has increased.

- Open-end funds raised significant capital in 2019, and the universe of investable funds continues to increase as the sector matures.

- In 2020 assets with guaranteed/contracted revenue or more inelastic demand patterns (e.g., renewables, telecoms, and utilities) fared better than assets with GDP/demand-based revenue (e.g., airports, seaports, midstream-related).

Opportunities in real estate

- The primary opportunity now is the purchase of mispriced publicly traded real estate equity and debt.

- Purchase of mezzanine loans from forced sellers is an emerging opportunity.

- Industrial development can be implemented by well-capitalized owners that do not need a construction loan.

- Distress, take-privates, rescue capital, recapitalizations, value add re-leasing strategies, and lending strategies will move into the opportunity set for investment as operating income is squeezed by tenants not paying rent.

- If core open-end real estate funds are on the sidelines due to redemption queues, there may be more opportunities to buy core assets with less competition or to buy assets from the funds themselves.

Infrastructure opportunities

- The primary opportunity now is the purchase of mispriced publicly traded infrastructure.

- Infrastructure lending if traditional lenders retrench

- Purchase of assets with GDP-linked revenue

- Pandemic could accelerate the purchase of assets or formation of PPPs from cash-strapped governments/municipalities.

- Purchase of assets from over-leveraged buyers

Timberland and farmland

- Volatility in commodity prices and changing supply chains may provide buying opportunities from overleveraged farmers and those that cannot shift crops away from restaurant/institutional use to grocery stores and suppliers that serve individual consumers.

- Unclear how the pandemic will affect timber markets and opportunities

- Institutional investment in timber has been waning for several years. The pandemic is unlikely to turn that tide.