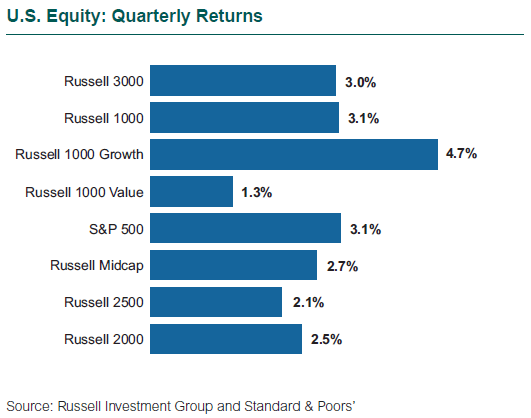

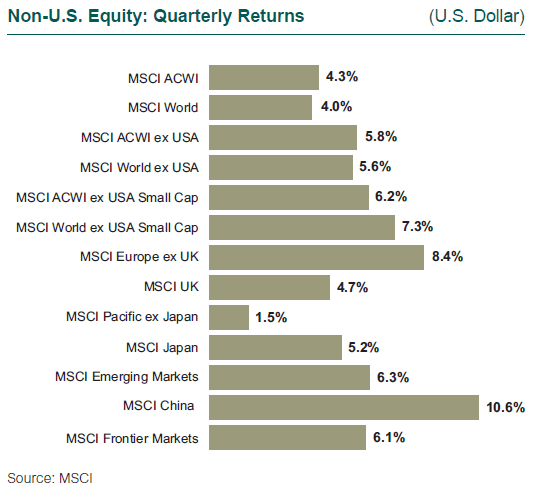

Spurred in part by recovery in Europe, non-U.S. equity markets outperformed U.S. stocks, and emerging markets topped developed markets. The Russell 3000 rose 3.0%, while the MSCI ACWI ex USA Index climbed 5.8%.

U.S. Stocks: Shocks, but No Slowing

Despite an increase in interest rates and turbulent events in the news, including disruptions within the Trump administration and terrorist attacks in the U.K., U.S. stocks continued to inch higher during the second quarter. Amid this volatile macro backdrop, S&P 500 companies reported the strongest quarterly earnings growth rate in six years (70% reported profits above expectations), and the S&P 500 Index hit a record high during the quarter.

Large cap stocks outperformed mid and small caps (S&P 500 Index: +3.1%; Russell 2000 Index: +2.5%). Strong earnings reports out of large cap stocks contributed to their leg up over small cap. Large cap was also buoyed by the continued flow of assets into passively managed strategies, especially ETF vehicles.

Small cap valuations kept stretching higher and, as a result, investors continued to take profits following a boon year in 2016. Growth outperformed value across large and small caps (Russell 1000 Growth: +4.7% vs. Russell 1000 Value: +1.3%; Russell 2000 Growth: +4.4% vs. Russell 2000 Value: +0.7%). The strong-performing “FAAMG” stocks (Facebook, Amazon, Apple, Microsoft, and Google) comprised 22% of the S&P 500’s return in the second quarter versus 32% in the first. Investors continued to be drawn to the top-line growth prospects and market share gains at these large, established firms.

Investor sentiment broadened across sectors in the second quarter compared to the first, as a wider range of firms reported positive results. Top sectors in the S&P 500 included Health Care (+7.1%), which rallied on the Trump administration’s prospect of change to the Affordable Care Act; Industrials (+4.7%), which benefited from declining commodity prices; Financials (+4.2%), spurred by the Fed’s announcement that 34 of the largest banks passed their stress tests, the largest cohort to do so since the tests began; and Tech (+4.1%), on the continued rise of those FAAMG stocks.

Energy (-6.4%) and Telecom (-7.0%) were the laggards. Crude oil prices fell due to an increase in supply, the result of a milder winter. In addition, improving efficiency within the U.S. fracking industry impacted prices. Within Telecom, competition for market share intensified in the increasingly commoditized (and consolidated) space.

Value stocks were hurt by Consumer Staples companies re-setting to more sensible valuations following the strong rally in 2016 that resulted from the “yield trade,” as investors sought the safety of strong dividends and lower-volatility stocks.

From a factor perspective, Momentum (+7.9%) was the top-performing factor while Enhanced Value (weighted to the forward price-earnings ratio, enterprise value/cash flow from operations, and price-to-book value of stocks in the factor) was the worst performer (+1.3%). Momentum was favored as investors sought stocks with demonstrated earnings growth.

Non-U.S. Stocks: Europe’s Recovery a Boost

Non-U.S. developed equity outperformed the U.S. for the second consecutive quarter, fueled by economic recovery in Europe and market-friendly outcomes in European elections. The MSCI Europe Index jumped 7.4% and the MSCI World ex USA Index notched a 5.6% gain, compared to the 3.1% rise in the S&P 500.

Gains were broad-based and helped by weakness in the U.S. dollar, which lost about 7% versus the euro and 5% versus a broad basket of currencies.

The euro rallied as a result of hawkish comments from the European Central Bank, coupled with improving European economic and sentiment indicators. European Financials benefited from expectations of higher rates, and European Industrials were propped up by stronger economic expectations.

Energy and Telecom Services were the only sectors in developed markets with negative second quarter returns. Energy fell as oil prices continue to languish due to an imbalance between supply and demand despite OPEC’s efforts to cut production. Telecom Services were buffeted by pricing pressure.

Within the MSCI indices, Europe ex-U.K. was up 8.4%, the U.K gained 4.7%, and Japan returned 5.2%. Small caps outperformed; the MSCI EAFE Small Cap Index rose 8.1%.

Looking at the global picture for stocks, the MSCI ACWI Index gained 4.3%, and developed and emerging markets outperformed the U.S. (MSCI ACWI ex USA Index: +5.8%), due largely to broad-based weakness in the U.S. dollar.

Emerging Markets: Tech Triumphs

Emerging markets outpaced the developed markets for the second straight quarter, propelled by Technology companies in China, South Korea, and Taiwan. The MSCI Emerging Markets Index gained 6.3%. Industry leaders in online and mobile commerce, payments, digital media, cloud computing, and smartphones are monopolizing the markets. That includes Tencent and Alibaba in China; Samsung in South Korea; and Taiwan Semiconductor Manufacturing in Taiwan.

Positive economic momentum and European election results placed Greece (+33.8%) and Hungary (+19.4%) as the top two performing countries in emerging markets. China rose 10.6%, while India’s gain was muted at +2.9%, though it remains a top performer year-to-date (+21%). The three worst-performing countries were Qatar (-10.9%), Russia (-10.0%), and Brazil (-6.7%). Qatar was hit after four Arab nations (Saudi Arabia, the United Arab Emirates, Egypt, and Bahrain) imposed an embargo, accusing the country of backing terrorism. Russia slumped because of declining oil prices and looming new sanctions. And continuing political instability in Brazil (including President Michel Temer’s bribery scandal) and commodity prices weighed on the country.

Quality, growth, and momentum factors dominated the market given the returns of large cap technology companies.

Non-U.S. Small Cap: All Over the Map

Developed non-U.S. small cap stocks outperformed large cap equity, as they were better positioned for the local economic recovery in Europe. But small cap equity lagged large cap in emerging markets, due to the performance of the large cap tech companies. The MSCI World ex USA Small Cap Index climbed 7.3% while the MSCI Emerging Markets Small Cap Index increased 2.6%.

Energy was the worst-performing sector in developed and emerging markets due to declining oil prices, which also caused growth to outperform value in developed small cap. Financials, the top-performing sector for the quarter, offset Energy; on the heels of positive economic data and election results, Eastern European Financials rallied.

3.1%

1st quarter return for the S&P 500 Index.