Survivorship bias reflects an exclusive focus on survivors instead of a broader context that includes non-survivors. When we evaluate portfolios of investments using peer groups, survivorship bias can create an illusion that hinders our ability to make informed decisions. Other biases in such data sets (e.g., self-reporting bias or selection bias) can also skew an analysis, but their effects are not as predictably systematic or difficult to observe. Survivorship bias is perhaps the most insidious of these biases because it is so hard to spot. Survivorship bias subtly hides data no longer present while only letting us consider evidence that is available today.

In the decade following the Global Financial Crisis (GFC), the degree of survivorship bias in peer groups has become more important to understand, particularly for hedge funds, since decisions to hire and fire should reflect an accurate assessment of performance.

Summarizing my recent essay in the Hedge Fund Monitor on survivorship bias, this post looks at where and how this bias can plague our typical peer group findings and thereby undermine our decision-making processes when reviewing performance. Using methodology developed by Callan, we correct for this bias within a sample of our peer groups to answer the question of how much it alters our historical narrative. Essentially, we “reanimate” the dead to better reflect the actual experience of investors. We can then avoid faulty judgments.

If not adjusted for survivorship bias, a peer group analysis can lead potentially to two forms of bad decisions, especially for hedge funds:

- Upwardly biased returns can lead to a more optimistic outlook for an asset class and therefore an inappropriate decision to invest based on such unrealistic expectations.

- An investor may develop bad perceptions of its manager’s performance. An “underperforming” manager may simply be at the bottom of an investment cycle that befell similar peers which disappeared. Firing such a manager can become a bad decision in hindsight.

Correcting for survivorship bias is not simple. If we append the dead member’s record with the average performance of survivors, the peer group’s dispersion of returns will collapse over time, creating an illusion of compressed distributions without meaningfully reflecting the risk of the under- or over-performing survivor going forward.

The more genuine approach is to systematically reallocate the terminated fund’s capital equally among the survivors. If we reanimate the dead by allocating these assets equally across all survivors, we capture the opportunity set available to investors at that time. The median manager calculation is now based on potential paths that all investors might experience, regardless of whether they began with a survivor or one that terminated.

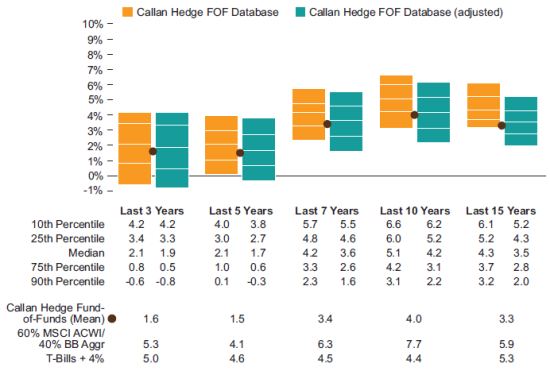

To illustrate this systematic difference across the full range of outcomes, we analyzed two sets of peer group comparisons. With unadjusted and survivorship-adjusted distributions beside each other over various time periods, the chart below looks at the Callan Hedge Fund-of-Funds (FOF) Database Group. Performance of the members of that peer group is net of fees and embodies the actual investor experience in diversified hedge fund portfolios since it includes implementation costs.

Survivorship Bias in the Callan Hedge FOF Database Group

Sources: Bloomberg Barclays, Callan, MSCI

The chart provides three notable observations.

- As we move from the shorter to longer time periods, the median performer’s annualized return, when survivorship-adjusted, falls more and more relative to the unadjusted median. These differences within each time period reflect a sobering 20% reduction, more or less, of the unadjusted median manager’s performance. This corrective look at a more realistic investor experience provides a better comparison to the performance of other alternatives, assuming those alternatives are not distorted with survivorship bias.

- The potential downside experience of an investor in hedge funds (i.e., being invested in a bottom-performing fund) is even more skewed. As we move back in time, the bottom-decile adjusted performance (i.e., 90th percentile) falls even faster relative to the unadjusted 90th percentile. This worsening downside risk of hedge fund implementations is not surprising since we are, in effect, reviving the performance of terminated funds, and those were likely to be the poorest-performing funds.

- Included in this chart is the associated mean return for each quarter based on the members present during that quarter. When strung together in a time series, the average annualized return of these mean returns embodies the survivors as well as those that subsequently terminated. As one might expect, the mean return over any given time period is reasonably close to the adjusted median that “revives” the terminated fund’s track record.

We also examined the effect of survivorship bias across peer groups representing a variety of strategies or asset classes to understand how the effect of survivorship bias differs across peer groups that display varying degrees of performance dispersion. Using the same framework of analysis described in the chart above, we found that, over the same time period that begins during the GFC, the spread between adjusted and unadjusted median managers widens with more volatile asset classes.

This review of survivorship bias and its impact on peer group analysis helps to precondition us to question the accuracy of peer group benchmarks. While we found that survivorship bias is notably present in most types of manager peer groups, it is worse within peer groups with high dispersion and associated mortality rates. Relative to other types of manager peer groups, this effect is particularly impactful when we analyze the history of individual hedge funds and hedge fund portfolios, including funds-of-funds. This better perspective enables a more honest assessment when we consider past performance relative to other opportunities. We will also be less inclined to harshly judge our own historical performance when we compare it to the broader peer group that now includes the worse-performing fund previously excluded.

While survivors in the popular AMC series “The Walking Dead” may not appreciate the dead walking among them, reanimated members of peer groups actually provide a helping hand to survivors when viewed in hindsight.