The market narrative of strong corporate earnings, falling unemployment, and tax reform had pumped up expectations for risk assets heading into 2018. However, hints that an overheated U.S. economy may be unable to absorb significant fiscal stimulus ahead spooked markets in the first quarter, leading to a spasm of risk-off behaviors. Despite the quarter’s rocky ride for stocks and bonds, hedge fund strategies were mostly positive.

Ground zero of this event in early February was the S&P 500 Index. When the VIX, a popular volatility gauge based on the S&P 500, exploded from roughly 17 to 38 on Feb. 5, several retail-oriented products that short such volatility, like XIV ETN, collapsed to an almost complete loss. Given the technically driven catalysts behind the violent unwind of this crowded trade, markets outside of U.S. large cap stocks suffered few lasting effects. However, the retail-oriented short-volatility products are gone, at least until memories of Feb. 5 fade.

As the Fed continued its tightening policies under new Chairman Jerome Powell during the quarter, the yield curve shifted upward by about 25 basis points, leading to a 2.4% loss on the Citi 10-Year Treasury. The quarter’s heavy issuance of Treasuries saturated a market used to a Fed that soaked up any net issuance. The dollar fell 2.3%, helping spot gold marginally (+1.4%) at a time when Fed tightening normally undermines the safe-haven asset. Oil prices also rose with the dollar weakness, but other commodities fell. Despite its dramatic sell-off in early February, the S&P 500 finished the quarter with only a 0.8% loss. The Bloomberg Corporate High Yield Index slipped 0.9%, although the floating rate-based CS Leveraged Loan Index gained 1.6%. The weakened dollar also supported the MSCI Emerging Markets Index (+1.4%).

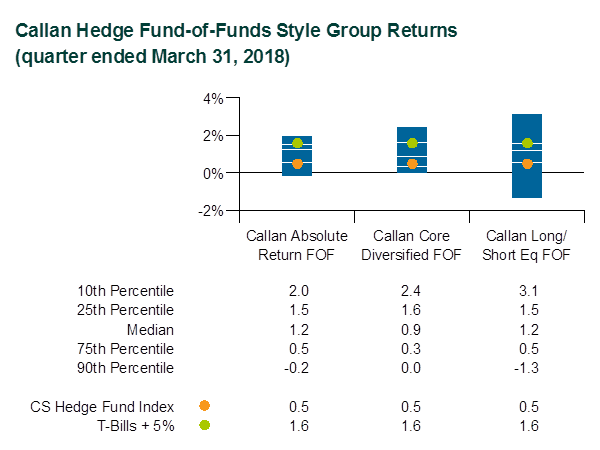

As a proxy of unmanaged hedge fund interests without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) grew 0.5%. Representing actual hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database gained 1.2%, net of all fees and expenses.

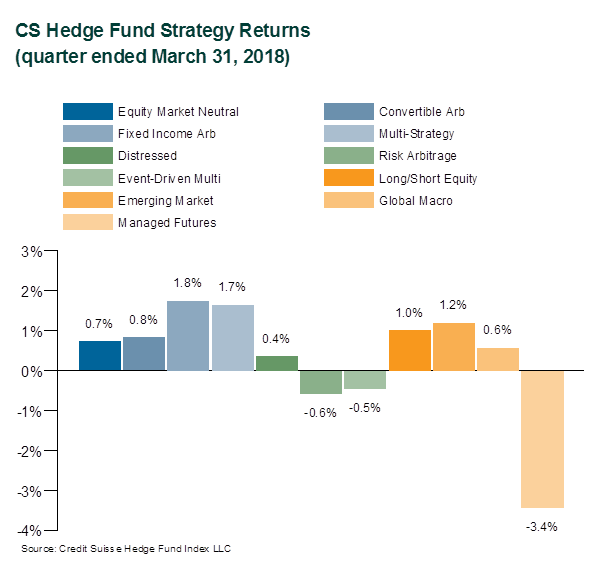

Within the CS HFI, the best-performing strategies last quarter were those long on illiquidity or complexity risks hedged with liquid risks. For example, Fixed Income Arbitrage accrued 1.8%. Allocating risk capital across an array of relative value trades, Multi-Strategy advanced 1.7%. Amid the quarter’s surge in equity volatility, Convertible Arbitrage appreciated 0.8%. Despite the quarter’s negative market beta, Long/Short Equity (+1.0%) provided investors with some positive alpha.

Some strategies suffered notable losses. Particularly hurt by the equity market’s sharp inflection point in February, Managed Futures dropped 3.4%. Normally uncorrelated with market risks, regulatory risks arose with a vengeance in the quarter against Risk Arbitrage (-0.6%). The Trump administration cited national security concerns in its opposition to Broadcom’s proposed Qualcomm acquisition, while the Department of Justice indicated antitrust concerns with CVS’s Aetna deal.

Within the Callan Hedge Fund-of-Funds Database, underlying market exposures did not dictate differentiated performance for the quarter. The median Callan Long/Short Equity FOF and the Callan Absolute Return FOF both notched 1.2% gains. With broad exposures to both non-directional and directional styles, the Core Diversified FOF rose 0.9%.

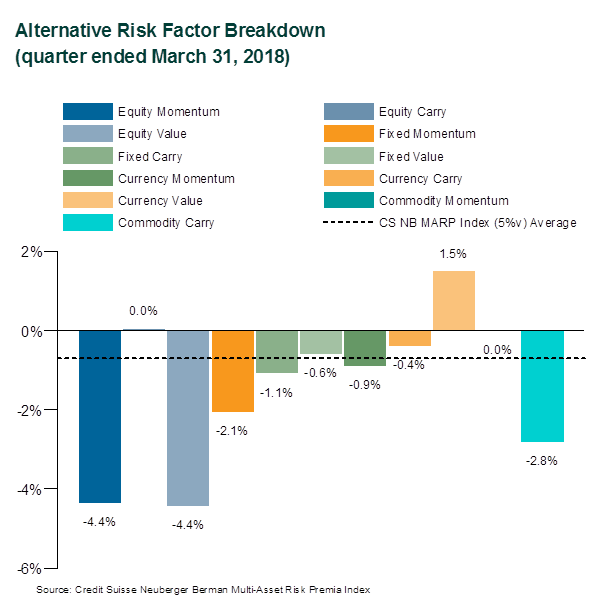

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but constructed at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

As a benchmark for these alternative risk premia, the Credit Suisse Neuberger Multi-Asset Risk Premia Index lost 0.7% in the first quarter based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, Currency Value (+1.5%) was the one positive factor for the quarter. Last quarter’s sudden market reversal caused Equity Momentum (-4.4%) to surrender much of its gain from the prior quarter. Normally a diversifier to that style, Equity Value (-4.4%) unexpectedly matched the fall of its momentum risk factor counterpart.

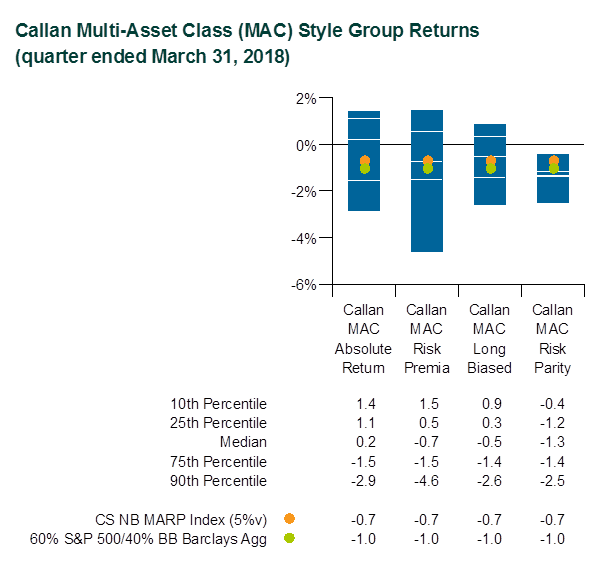

Most of the Callan Multi-Asset Class (MAC) Style Groups experienced weakness in the quarter, which was consistent with the market index and alternative beta returns cited above. Only Absolute Return MACs (+0.2%) eked out a gain. Risk Parity (-1.3%) fell more than the unlevered benchmark of 60% S&P 500/40% Bloomberg Barclays US Aggregate Bond Index (-1.0%). Despite declining markets in both equities and rates, the Callan Long-Biased MAC lost only 0.5%. Though normally less correlated with markets, Risk Premia (-0.7%) exhibited higher-than-expected losses during February’s sell-off with little dispersion among strategies. For the full quarter, though, the peer group showed significant dispersion, reflecting different volatility targets and styles.