A flurry of political skirmishes and uneven growth in Asia failed to deter non-U.S. equity investors, and the “risk-on” theme of last year continued into 2017. The weak U.S. dollar also bolstered overseas returns for U.S. investors.

The MSCI ACWI ex USA Index jumped 7.86% during the quarter. All of its sectors were in the black, with the exception of Energy (-0.91%), which was hurt by falling oil prices. Economically sensitive sectors led the pack: Information Technology contributed 14.59% and Industrials added 9.48%. Defensive and cyclical sectors such as Telecommunications (+5.98%) and Real Estate (+6.72%) lagged.

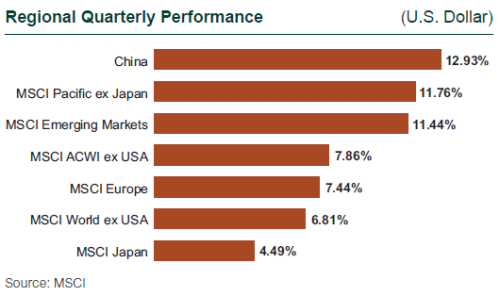

Helped by a weaker dollar, emerging markets (MSCI Emerging Markets Index: +11.44%) outperformed their developed peers (MSCI World ex USA Index: +6.81% and MSCI EAFE Index: +7.25%). The MSCI ACWI ex USA Growth Index (+9.13%) resumed dominance over the MSCI ACWI ex USA Value Index (+6.68%). Small cap stocks also performed well (MSCI ACWI ex USA Small Cap Index: +8.78%).

Politics continued to roil Europe. Most notably, British Prime Minister Theresa May triggered Article 50 of the Lisbon Treaty on March 29, giving the U.K. two years to negotiate an exit from the European Union (EU). The negotiations are likely to be arduous, particularly concerning trade and immigration.

France’s presidential elections were held in April and a runoff is slated for May. Marine Le Pen, the far right contender and opponent of the EU, finished second in the first round of voting but is widely expected to lose in May to Emmanuel Macron, a more centrist leader and supporter of the EU.

On the other hand, the economic outlook brightened in the euro zone. Inflation hit a four-year high (2%) in February. Fourth quarter GDP was 1.7% (year-over-year) and positive in each country except Greece (-1.2%). The MSCI Europe Index jumped 7.44% in the first quarter; all of the countries posted positive returns. Spain (+14.76%) and the Netherlands (+11.33%) contributed most, while Ireland (+3.75%) and Norway (+1.43%) lagged. Information Technology (+12.89%) and Industrials (+10.39%) rallied, while Energy stocks (-3.10%) brought up the rear.

In Southeast Asia and the Pacific, Japan’s economy grew at a meager (yet notably positive) annualized 1.2% in the fourth quarter. Industrial output and inflation rose and unemployment fell. But the stronger yen (+5%) dampened exporters’ returns, and Japan ended the quarter up just 4.49%; only New Zealand posted worse returns (+1.95%) in the region, owing to a faltering Materials sector (-19.33%). Singapore (+13.46%) and Hong Kong (+13.41%) fared best, thanks to thriving real estate markets. Australia advanced 10.98%, propped up by currency strength. The MSCI Pacific Index was up 6.92% and excluding Japan jumped even more (MSCI Pacific ex Japan Index: +11.76%).

Emerging market returns were boosted by a weaker dollar, economic growth in China, and rising industrial metal prices. India (+17.12%) and South Korea (+16.85%) were the top performers. The party of India’s prime minister, Narendra Modi, won a key regional election despite an abrupt currency recall last year, and the central bank predicted strong economic growth for the next 12 months. Copious gains in IT stocks bolstered Korean returns. China, which makes up more than a quarter of the MSCI Emerging Markets Index, also experienced growth in its IT sector, as well as in Manufacturing and Real Estate. Fourth quarter GDP came in at 6.8%, and China ended the quarter up 12.93%. Mexico was among the top performers (+16.03%) as the peso rebounded 9%. Russia (-4.61%) and Greece (-3.49%) were the region’s poorest performers. Russia was hurt by falling oil prices, and Greece by negative GDP growth.

7.86%

The gain in the MSCI ACWI ex USA Index during the quarter.