Listen to This Blog Post

Private credit gained nearly 9% over the last 10 years, comfortably above both a leveraged loan and high yield benchmark. Fundraising in 4Q24 hit an eight-year low and has declined, on an annual basis, for three straight years. The private credit loan market remained slow in 4Q, compared to the first part of the year, but there is still a big appetite for deals.

Key trends in private credit

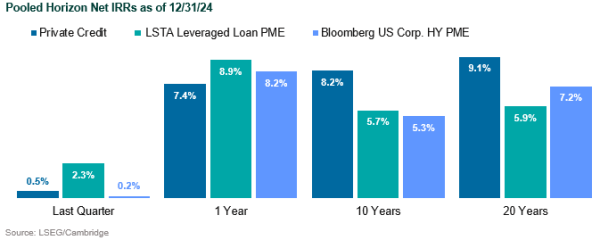

Performance | Private credit returns vary across sub-asset class and underlying return drivers. Over the past 10 years the asset class has generated a net IRR of 8.2%, outperforming leveraged loans. Higher-risk strategies have performed better than lower-risk strategies.

Fundraising | The number of funds raised in 4Q24 was the lowest in eight years. Private credit fundraising ended 2024 down, the third yearly decline in a row. Direct lending continues to dominate fundraises with special situations following. There is increased interest in specialty finance/ABL strategies for more mature PC portfolios.

Assets | North American private credit assets under management (AUM) is expected to grow significantly, from $1.01 trillion in 2024 to $1.74 trillion in 2029, representing an annualized growth rate of 11%. European private debt AUM is projected to grow at a slower pace of 7.8%, reflecting resilience despite a more challenging economic environment.

Loan Markets | In 4Q24, both the private credit and syndicated loans markets remained slow, compared to the first half of the year. Despite the low volume, both markets continue to have a large appetite for deals. Direct lending volumes have been relatively more stable but remain at a lower level compared to institutional issuance in 2024 YTD, showing approximately $50 to $55 billion in 1Q24 and 2Q.

Yields | U.S. sub-investment grade corporate yields rose dramatically at the beginning of 2022 with yields peaking in September. This was a combination of higher interest rates due to tighter Fed policy and a widening of high yield spreads. Effective yields dropped in 2024 but then increased to start 2025. Spreads contracted in 2024, a continuation from late 2023, due to stronger credit conditions as the U.S. economic outlook improved. However, in April 2025 we observed a spike in high yield effective yields.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.