Listen to This Blog Post

Private credit saw gains in 3Q24, but lagged a key benchmark. Fundraising was the strongest since 4Q23, with direct lending responsible for the vast majority. The market is poised for strong growth as institutional investors continue to add allocations.

Key trends in private credit

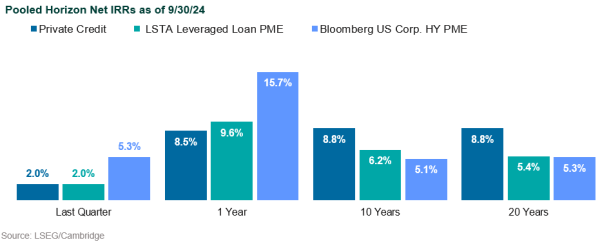

- Private credit gained 2.0% in 3Q24, the most recent quarter available. That matched the LSTA Leveraged Loan PME Index but significantly trailed the Bloomberg US Corporate High Yield PME Index. Results over the trailing one year were roughly the same, but over 5-, 10-, and 20-year time periods private credit topped the two benchmarks.

- Private credit performance varies across sub-asset class and underlying return drivers. Higher-risk strategies have performed better than lower-risk strategies.

- Fundraising for private debt was the strongest since 4Q23, with $51 billion raised.

- Direct lending was responsible for 76% of 3Q fundraising, with $39 billion raised.

- While direct lending continues to dominate fundraises, we are noticing increased interest in specialty finance strategies for more mature PC portfolios.

- Private credit stayed in high demand among Callan clients, and a number of large DB plans are looking to increase their allocations from 2%–3% to 5%–10%.

- North American private debt AUM is expected to grow significantly, from $1.01 trillion in 2024 to $1.74 trillion in 2029, representing an annualized growth rate of 11%. European private debt AUM is projected to grow at a slower pace of 8%, reflecting resilience despite a more challenging economic environment.

- Fundraising in Europe is forecast to remain static, which could create upside potential as reduced competition for deals may improve investment opportunities.

- The private debt market is positioned to maintain strong growth, particularly in North America, while Europe’s steadier trajectory still offers attractive prospects in a less crowded landscape.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.