Listen to This Blog Post

The market backdrop served as a strong tailwind for most hedge fund strategies in 3Q24. U.S. equity markets ended a volatile quarter higher, driven by strong corporate earnings and the Federal Reserve’s larger-than-expected interest rate cut in September. Credit indices saw gains across the board, with investment grade and high yield bond indices outperforming levered loans. Emerging, European, and Asian markets were mixed. Within emerging markets, China outperformed its peers due to improved investor sentiment following the government’s announcement of a monetary stimulus package.

3Q24 hedge funds performance

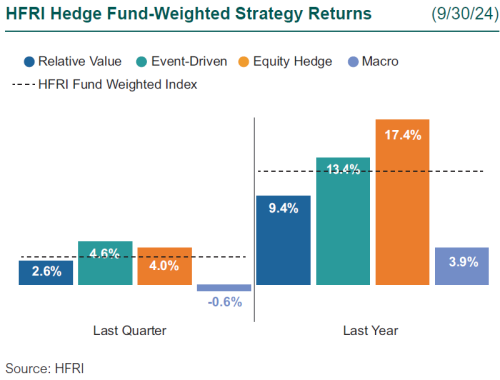

In 3Q, hedge funds had another strong performance, as strategies with higher beta to equity markets saw gains. Equity hedge strategies led returns, driven by generalist managers and those with a focus on health care. Relative value strategies were positive, as performance was driven by fundamental and systematic equity relative value. Event-driven strategies also had a strong quarter, as a focus on deep value companies and mergers drove performance. Macro strategies ended slightly lower, as gains from long positions in U.S., European, and U.K. rates, fixed income relative value trading in the U.S., and long gold were offset by losses from shorting Japanese rates, long positions in the U.S. dollar, and going long Japanese equities.

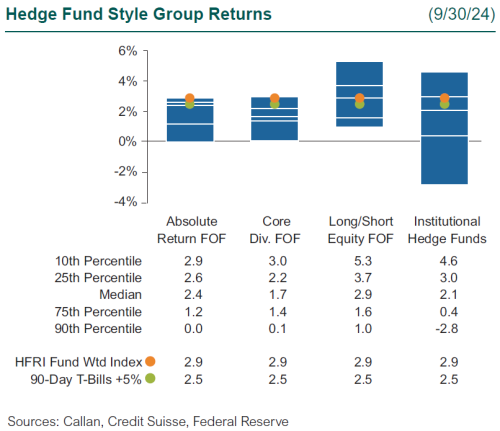

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group member rose 2.1%. Within this style group of 50 peers, the average hedge credit manager gained 2.9%, driven by interest rate volatility. Meanwhile, the average hedge equity manager added 0.3%, as those focused on health care, utilities, and real estate drove performance. The median Callan Institutional hedge rates manager rose 2.9%, largely driven by relative value fixed income trades.

Within the HFRI indices, the best-performing strategy was event-driven, which was up 4.6%, as managers gained from their positioning to out-of-favor equities. Equity hedge strategies rose 4.0%, as managers profited off dispersion in utilities, health care, and real estate. Relative value strategies were up 2.6%, as managers benefited from the Fed lowering interest rates. Macro strategies ended 0.6% lower, as a weakening dollar offset gains from rates positioning during the quarter.

Across the Callan Hedge FOF database, the median Callan Long-Short Equity FOF ended 2.9% higher, as managers with a more generalist approach were able to profit off dispersion across sectors. Meanwhile, the median Callan Core Diversified FOF gained 1.7%, as equity and event-driven strategies drove performance. The median Callan Absolute Return FOF gained 2.4%, as a higher allocation to relative value strategies drove performance.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost.

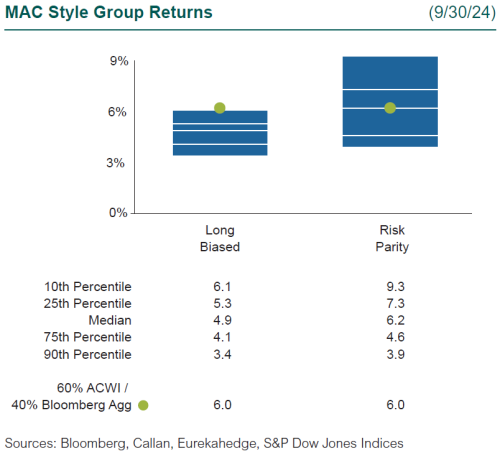

Within Callan’s database of liquid alternative solutions, the median Callan MAC Long Biased manager rose 4.9%, as the strong equity rally pushed performance higher. The Callan MAC Risk Parity peer group rose 6.2%, as equities and fixed income positioning drove performance.

If consensus expectations are met for a sustained stable growth and low inflation environment, markets can continue to grind higher, and corporate profit margins and balance sheets for the largest companies can remain healthy. With markets priced close to perfection, one bad data point can cause markets to sell off. Against this current backdrop, Callan is focused on managers with the skill to generate alpha both on the long and short side across equities, fixed income, rates, currencies, and commodities.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.