Listen to This Blog Post

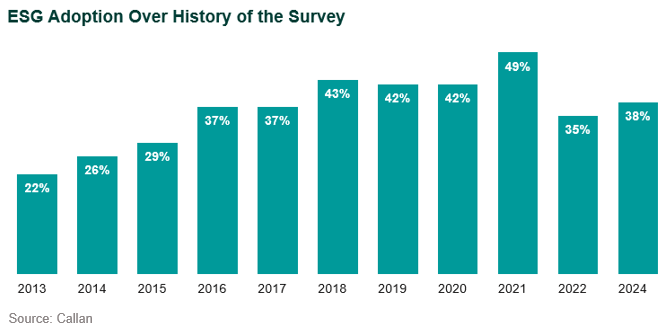

Callan’s regular survey on environmental, social, and governance (ESG) principles is designed to better understand the views of institutional investors and the trends driving ESG adoption. In our recently published 2024 ESG Survey, available at the link above, we found that 38% of respondents incorporated ESG into investment decisions, a very similar level to when we last conducted the survey in 2022 (35%). The highest percentage of respondents incorporating ESG factors occurred in 2021 (49%), when interest in ESG surged during the pandemic as awareness of the relationship between financial markets and the physical world was intensified. Changes in ESG adoption over recent years can also be attributed in large part to a significant drop in the share of public plans incorporating ESG, likely due to a shift in survey respondents and the heightened politicization surrounding ESG.

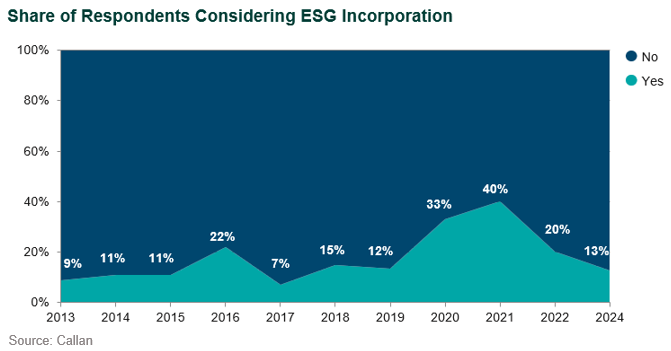

At the same time, we found that 13% of respondents not yet incorporating ESG were considering doing so, a decline from the figure in 2022 (20%) but closer in line with most years prior to 2020. We observed a spike in 2020–21 that has since moderated. Foundations were those most commonly stating that they are considering ESG incorporation.

This year’s survey reflects input from 90 U.S. institutional investors. Respondents included public, corporate, and nonprofit defined benefit (DB) and defined contribution (DC) plans, as well as endowments and foundations, with assets under management (AUM) ranging from small (under $500 million) to large (more than $20 billion). Almost half of respondents were public plans, either DB or DC, the largest share by investor type, while endowments and foundations represented almost 30% of respondents. By size, 45% of respondents have $3 billion or more in assets, while 33% have less than $500 million in assets. By sector, the largest share (38%) came from the government.

Highlights from the 2024 ESG Survey

- Investor Type: Foundations (61%) incorporated ESG at the highest rate among survey participants, followed by endowments (38%). Of corporate plans, 31% incorporated ESG, up from 20% in 2021. But only 27% of public plans incorporated ESG, closely in line with 2022 results (24%) but down sharply from 2021 (63%), reflective of the variety of public plans that can make up the respondent group in different surveys and enhanced political scrutiny.

- Investor Size: 47% of small-sized institutional investors (<$500 million) incorporated ESG, the highest by investor size and a sharp increase from previous years but consistent with 2018 results. Investors between $500 million to $3 billion in AUM were the least likely to incorporate ESG at 20% compared to 33% in 2022.

- Investor Location: ESG adoption was highest by investors in the Pacific (67%) and Northeast (44%) and lowest by those in the Southeast (23%). We observe increasingly polarized ESG policies at the state and municipal level. There are both states requiring ESG incorporation by public plans and states banning ESG incorporation in various forms.

- Adoption over time: Three-fourths of respondents that incorporated ESG began doing so within the last eight years. 47% of investors began incorporating ESG in just the last three years (2021 to present).

- DC plans: The survey also highlighted data from the proprietary Callan DC Index™ and reported that 17% of DC plans offered a dedicated ESG option. While 29% of non-corporate DC plans offered a standalone option, only 5% of corporate plans did. Using the results of our most recent Callan DC Trends Survey, we also noted that 9% of plan sponsors intend to add an ESG option in the next year.

- Those not incorporating it: 49% of respondents not incorporating ESG cited they will not consider any factors that are not purely financial in their investment decision-making, 38% said they did not believe there is convincing research tying ESG to better performance, and 33% said the benefits of doing so were unproven or unclear.

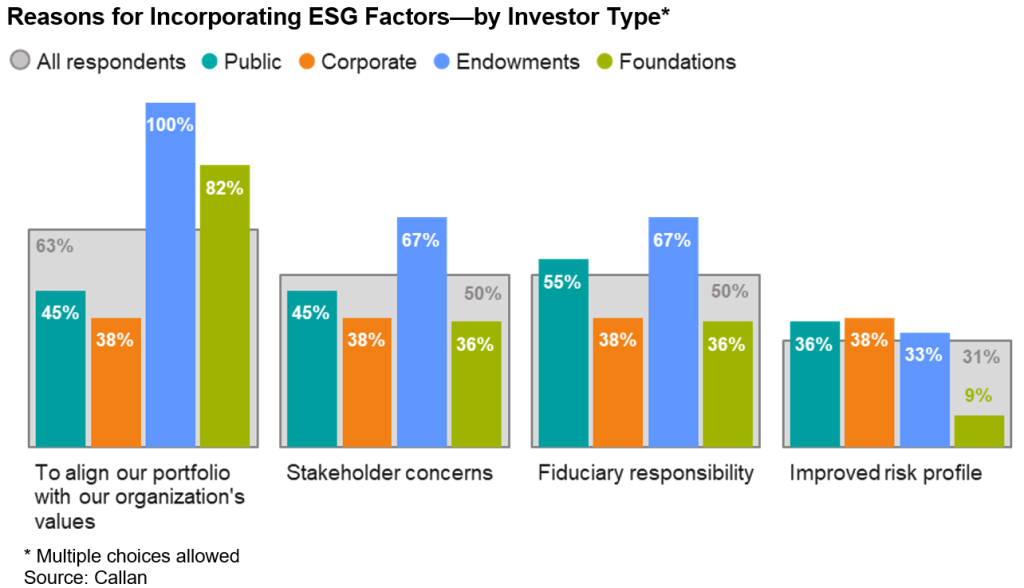

- Motivations: The most frequently cited reason for incorporating ESG was alignment of the portfolio with the organization’s values, followed by stakeholder concerns and fiduciary responsibility.

- Implementation: Our survey broke implementation down into two methods: inclusion in investment decision-making and adoption into the manager evaluation process. The most common form of ESG incorporation in the investment decision-making process was adding language to the investment policy statement, with nearly all respondents that incorporated ESG doing this. Regarding manager selection and monitoring, two-thirds of respondents that consider ESG incorporate it with every investment manager selection and communicate to investment managers that ESG is important to their investment program.

- DEI: We observed a spike in interest in diversity, equity, and inclusion (DEI) as an impact focus from our 2022 study, when 11% of respondents cited that as an area of focus. This year, the percentage is roughly triple, at 32%.

- Environmental Actions: A significant change from our 2022 survey is that 24% report having implemented carbon footprint portfolio measurement, up from only 4% in 2022. Another 19% of respondents are exploring this action in 2024.

- Allocation: Only 13% of respondents that incorporated ESG maintained an ESG allocation separate from their main portfolio, down from 26% in 2022, indicating broader integration is preferred.

- Product interest: Active U.S. equity (38%) topped the list of public markets asset classes for which investors sought more product offerings, followed by active U.S. fixed income (31%). Private equity (35%) led the list of private markets strategies.

We plan to continue this survey of institutional investors biannually, alternating with our survey of asset managers and ESG implementation.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.