Listen to This Blog Post

Welcome to another edition of the Callan Client Question, where our Corporate DB Plan Focus Group shares answers to interesting issues raised by our clients. This edition tackles the questions, “Are equity market returns more volatile in a presidential election year, and is there anything specific I should do?” The answer is the classic consulting answer, “It depends!”

We based our analysis on S&P 500 risk and returns going back to 1972, the year the Miami Dolphins ran the table and became the first and only NFL team in history to go undefeated en route to a Super Bowl victory.

We reviewed the results in two ways:

- Annual calendar year volatility measured by standard deviation

- Returns up to and after the election

Annual calendar year volatility: Lower in election years

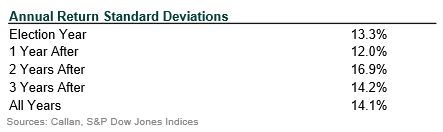

The average standard deviation for the S&P 500 from 1972 through 2023 was 14.1%.

Contrary to what one might assume, returns in an election year, and the year after, were the least volatile during this period. Other similar studies show mixed results, struggling to find evidence of a widespread increase in volatility in election years.

The table below illustrates the annualized volatility by year starting with an election year.

The result: Election year volatility is lower than average. Now let’s turn our focus to looking at market returns.

Pre/post-election year returns: Usually but not always up

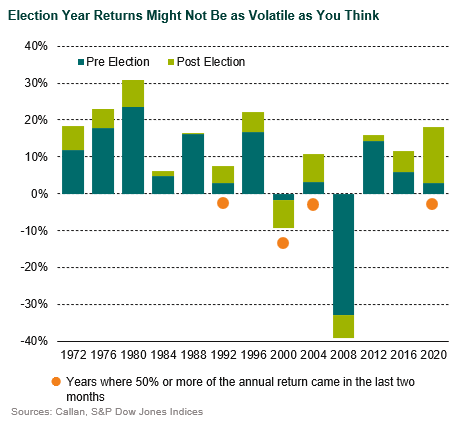

The graph below represents returns split into two pieces, the 10-month returns prior to the election and the trailing 2 months of the year (after the election). We found a couple of interesting factoids:

- The election results never flipped a trend. If stocks were positive in the first 10 months, they were also positive in the last 2 months of the year.

- There were four periods where the last two months of the year contained more than 50% of the annual return for the year, and the 2016 election was pretty darn close to being split 50/50. So in 5 of the 13 years reviewed, the return during the year was pretty volatile.

We know that the market craves certainty, and an election year is no different. This might explain why returns have never “flipped” in an election year and could also explain why we see the market “pop” afterwards, but that surely doesn’t explain everything. What we did find interesting was the second and third years of a presidency seemed to be the most volatile.

Here’s the answer to the second question: What should institutional investors do? Our response is more straightforward than our answer to the first question. Regardless of who or what party is in office, we believe that taking a long-term and disciplined investment process remains the most important decision investors can make. As to voters …

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.