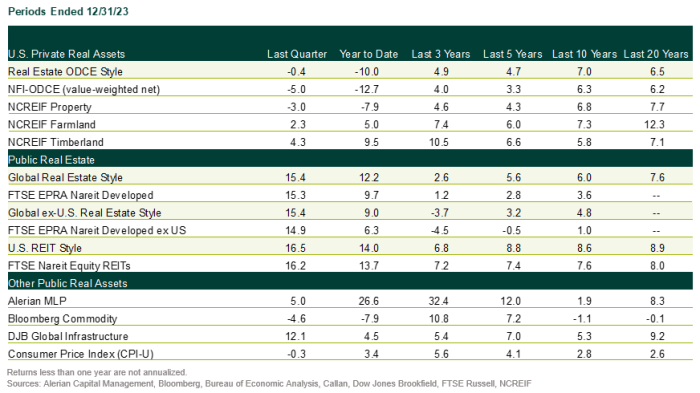

Private real estate indices fell in 4Q23, mostly due to appreciation losses. The NCREIF Property Index was off 4.1% and the NCREIF ODCE Index dropped 4.8%.

Real estate investment trusts (REITs), on the other hand, jumped and topped stock indices, both in the U.S. and globally. The outperformance in the U.S stemmed from dampening inflation. Europe was the top-performing region, helped by currency tailwinds.

Private real estate valuations reflect higher rates

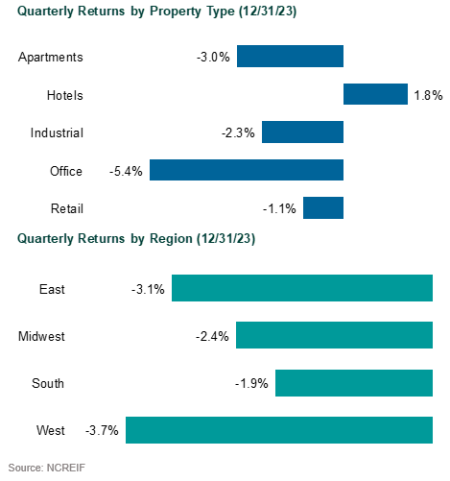

- The NCREIF Property Index, a measure of U.S. institutional real estate assets, fell 3.0% during 4Q23. The income return was 1.1% while the appreciation return was -4.1%.

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 1.8%.

- Office finished last with a loss of 5.4%.

- Regionally, the South led with a loss of 1.9%, while the West was the worst performer with a drop of 3.7%.

- The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, fell 4.8% during 4Q, with an income return of 1.0% and an appreciation return of -5.8%.

REITs outperform equities

- The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, rose 15.6% during 4Q23.

- U.S. REITs, as measured by the FTSE Nareit Equity REITs Index, increased 16.2%.

- The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, gained 8.6%.

- European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), jumped 26.8%.

- U.S. REITs outperformed the S&P 500 (11.7%). They also topped Asia REITs but underperformed Europe.

- The outperformance in the U.S. was driven by dampening inflation, coupled with a more dovish Federal Reserve sentiment sparking a rally to close the year.

- The office sector outperformed, coming off its lows.

- Gaming, residential, health care, and data center lagged, impacted by interest rate challenges and prior strong performances.

- The FTSE EPRA Nareit Developed Asia Index (USD) rose 8.6% during the quarter. China’s economic outlook remains uncertain, exacerbated by geopolitical tensions and underwhelming stimulus.

- The FTSE EPRA Nareit Developed Europe Index (USD) increased by 26.8% during the quarter.

- Europe was the top-performing region, driven by meaningful currency tailwinds. Expectations of a dovish central bank were driven by weakening economic data.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.