This is one in a series of quarterly blog posts providing context for public defined benefit (DB) plans about their returns over time, from our Public DB Plan Focus Group. Previous posts in the series can be found here.

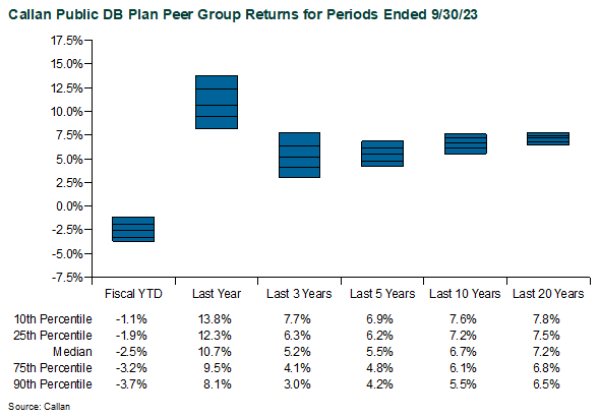

After strong results in fiscal year 2023 (median public plan return: 9.27%), public plans are off to a cold start in fiscal year 2024. Losses were experienced across most asset classes as investors braced for “higher for longer” interest rates. Both public equities and core fixed income, the largest allocations among public plans (average allocation: 52% and 24%, respectively), suffered losses in excess of 3% during the quarter.

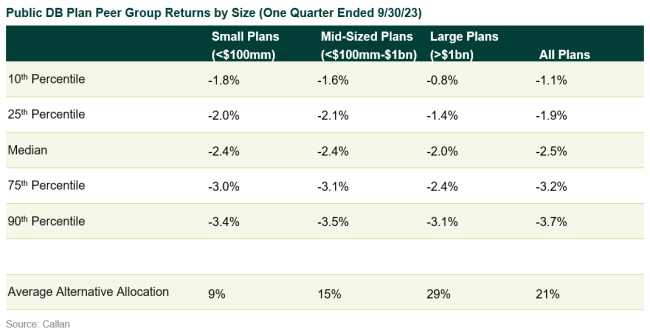

At the risk of sounding like a broken record, the size of the alternatives allocations was once again indicative of relative results, with private equity and hedge funds among the limited asset classes with positive results during the quarter. Large plans have historically held higher allocations to alternatives, and have tended to outperform in market selloffs, as general partners are less reactive in writing down their valuations.

Callan is emphatic in recommending clients not overreact to a single quarter, or even year’s results, as returns already look rosier in the second fiscal quarter (QTD through 11/20/23 – MSCI ACWI: 5.29%; Bloomberg Aggregate: 1.96%). If one thing is certain over the last 21 months, it is that markets will be volatile. Public plans should be focused on the long term, determining asset allocation changes through strategic planning projects rather than reacting to the whims of the market.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.