Private real estate indices continued to fall in 2Q23, with losses due to appreciation the primary driver of performance. Real estate investment trusts (REITs) saw gains during the quarter, but their performance lagged comparable public equity benchmarks, in part due to headwinds from rising interest rates.

Real assets across the board fell in the quarter, buffeted by an array of concerns, including the slowdown in China, rising interest rates, and a fall in the demand for oil.

Private real estate falls but income returns were positive

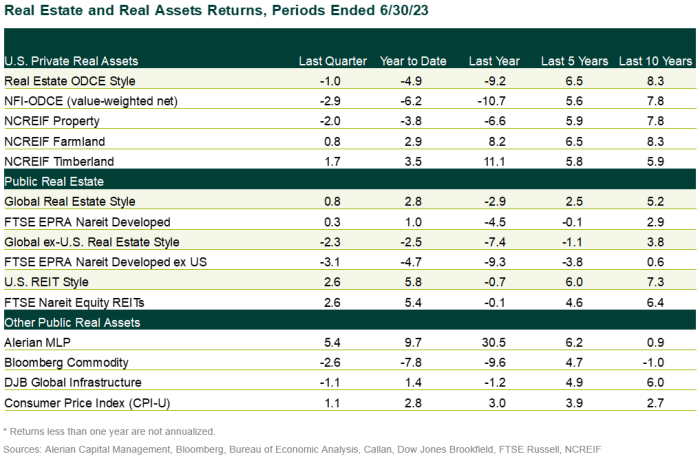

- The NCREIF Property Index, a measure of U.S. institutional real estate assets, fell 2.0% during 2Q23. The income return was 1.0% while the appreciation return was –3.0%.

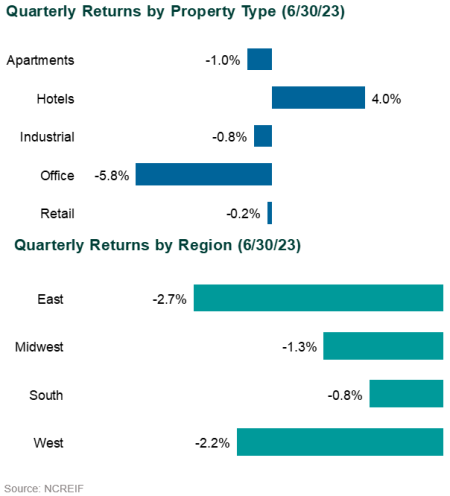

- Hotels, which represent a small portion of the index, led property sector performance with a gain of 4.0%. Office finished last with a loss of 5.8%.

- Regionally, the South led with a loss of 0.8%, while the East was the worst performer with a loss of 2.7%.

- The NCREIF Open-End Diversified Core Equity Index, representing equity ownership positions in U.S. core real estate, fell 2.7% during 2Q, with an income return of 0.9% and an appreciation return of -3.6%.

REITs underperform equities

- Global REITs underperformed in 2Q23, rising 0.3% compared to a 6.8% rise for global equities (MSCI World).

- U.S. REITs rose 2.6% in 2Q23, in contrast with the S&P 500 Index, which rose 8.7%.

- The outperformance in the U.S. was driven by the resilient U.S. economy but continued to face headwinds due to higher interest rates and negative sentiment in the capital markets.

Real assets down across the board

- The S&P GSCI fell 2.7% in 2Q.

- WTI Crude ended the quarter at $70.64/barrel, down from $75.67/barrel on 3/31.

- Copper (-8%) fell on concerns over ebbing global demand and a slowdown in China, and gold (S&P Gold Spot Price: -2.9%) was hurt by lowered expectations for inflation and reduced safe-haven demand.

- TIPS (Bloomberg TIPS: -1.4%) were hurt by rising interest rates.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.