The life sciences industry has seen significant growth in recent years. Not only has it been resilient through the COVID-19 pandemic, it has experienced rapid expansion from health care needs propelled by the pandemic. Demographics in the U.S. also contribute to industry growth, as 29% of the population is 55 or older, and that share will grow with increasing life expectancy. The need for technological and scientific advancements combined with extraordinary innovations has transformed the bio-medicine industry. These innovations come from an influx of new companies that require lab space in top life sciences markets. As a result of these industry and market fundamentals, investment demand from institutional investors for life sciences properties has increased.

This blog post summarizes my recent paper on this relatively new sector within the real estate asset class. For the full paper, please click on the link above.

Life Sciences Offices, Explained

Life sciences properties provide lab and office space for scientists to perform research and development for therapies, technologies, regenerative medicine, genomics, pharmaceutical and vaccine advancements, and cancer treatments. Most life sciences real estate inventory is developed with exact specifications that differ dramatically from traditional office buildings, creating an ecosystem within the building for life sciences tenants.

Demand and the strength of the life sciences industry has led to significant job growth. In turn, there is an increasing need for life sciences lab and office space. Over the past five years, lab space demand, pharmaceutical R&D spending, NIH funding, and FDA drug approvals have all accelerated, with U.S. biotech sector R&D revenues forecast to grow to more than $350 billion in 2028, a significant increase from $250 billion in 2021, according to JLL.

Because high-quality lab space is purpose-built for a life sciences company, the use of life sciences space is unique. In addition to property specifications and interior buildouts, life sciences jobs usually cannot be done from home due to lab resources and the specific environments required. For this reason, occupancy at life sciences properties remains high compared to traditional offices.

Additionally, because life sciences tenants spend significant capital on customizing and building out interior spaces, the retention rate for tenants is high due to the costly nature of changing spaces. And the rent expense on a life sciences company’s balance sheet is small compared to other costs, making life sciences tenants amenable to market rate rental increases, according to Nuveen Real Estate.

Finally, life sciences rental rates are significantly higher than office rental rates. For example, top life sciences clusters have achieved 63% higher rent growth over the past five years compared to office rents within the same clusters, according to JLL.

There is a relatively small amount of total square feet of life sciences space in the U.S. (200 million square feet compared to 4 billion square feet for office space). The limited amount of life sciences real estate offers meaningful growth potential for nimble investors.

As a result of both the building and market requirements for a life sciences property, the projected demand for life sciences space surpasses the projected supply. Demand for life sciences properties peaked in mid-2021, which resulted in very low vacancy rates and high rent growth across U.S. life sciences markets. Although vacancy rates in some markets have increased lately, it has been largely attributable to the delivery of new inventory rather than a decrease in demand.

As the life sciences sector is not immune to the current high interest rate environment, development in the sector is expected to slow down significantly due to high financing costs. It is important to focus on the long-term fundamentals and demand drivers of the sector despite short-term market turbulence. The rate of innovation and technological advancements in the industry have compounded at a rapid pace despite current, short-term capital markets challenges.

Investor Considerations

Diversification

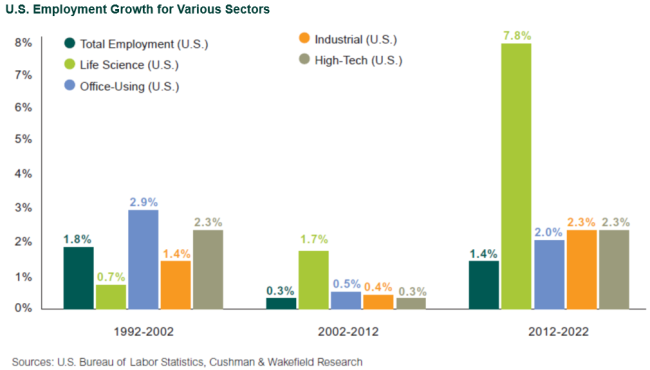

The life sciences sector can be a good diversifier within a traditional real estate portfolio. The sector has a history of outperforming in economic downturns and has historically been counter-cyclical to the typical real estate cycle. Life sciences employment has remained strong throughout previous downturns and outpaced other sectors, including office, since 2002. Additionally, since 2012, life sciences employment growth has far exceeded office, industrial, and tech employment.

Manager Experience

Life sciences buildings generally require more capital expenditures, specific property management skills, and longer-term development timelines, and they are frequently leased to smaller tenants that may not have a credit rating to underwrite. To evaluate a life sciences tenant with no credit rating requires specialized expertise. Generally, a life sciences investment manager should have the following experience and capabilities:

- Team with a deep history of developing and converting life sciences buildings

- Experience underwriting life sciences tenants

- Track record of sourcing and exiting life sciences investments

- Vertically integrated and deep team and/or long-standing relationships with operating partners that have experience with local markets and the development and management of life sciences properties

Performance

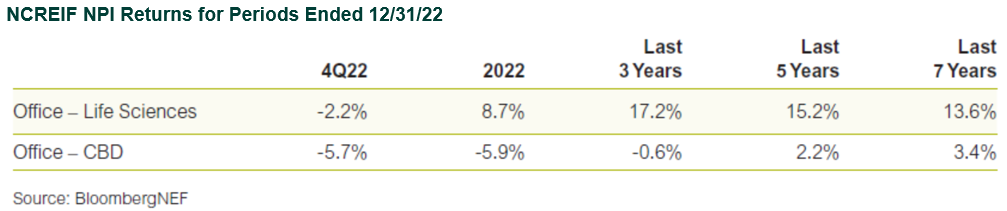

Seven out of the 26 active funds in the NCREIF ODCE Index invest in the life sciences sector. Across these seven ODCE funds, the core and core plus life sciences investments compared to the core and core plus office investments have outperformed over each time period over the past 10 years.

As the life sciences sector continues to grow, it will likely become more accessible to investors. As more managers enter the life sciences investing space, more competition will arise, creating a better environment for investors to choose the team, strategy, and risk profile that best fits their overall portfolio targets.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.