This blog post from our Corporate DB Plan Focus Group is one in a series of monthly updates about the impact of interest rates on corporate defined benefit (DB) plans, designed to highlight trends in the market and inform plan sponsors about significant developments.

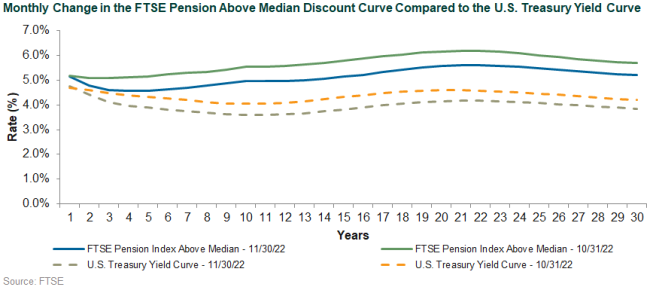

Discount rates declined in November, retracing, in part, some of their steady climb northward this year. In November, the discount rate for the Callan illustrative plan (representing a typical shorter-duration corporate DB plan), which compares to the liability duration of FTSE’s Pension Liability Index–Short, fell by 56 bps. In November, long AA corporate spreads, as measured by the Bloomberg Long Corporate AA Index, narrowed by 19 bps. Interestingly, the last time long corporate AA spreads tightened this much was during November 2020, which hosted both a presidential election and the announcement of not one but two viable COVID-19 vaccines. Interest rates also fell, with the 10-year Treasury note falling by 38 bps over the month to 3.69%, after reaching a high of 4.23% on Oct. 24.

What Drove the November 2022 Discount Rate Changes

Part of the rally in spreads and rates was related to Chairman Jerome Powell’s statement that the Federal Open Market Committee (FOMC) will seek to “moderate the pace of rate increases,” as the Fed approaches the level needed to bring inflation down. It should be noted that the meaningful uptick in rates, or increase in borrowing costs, has slowed the volume of financing across many spread sectors.

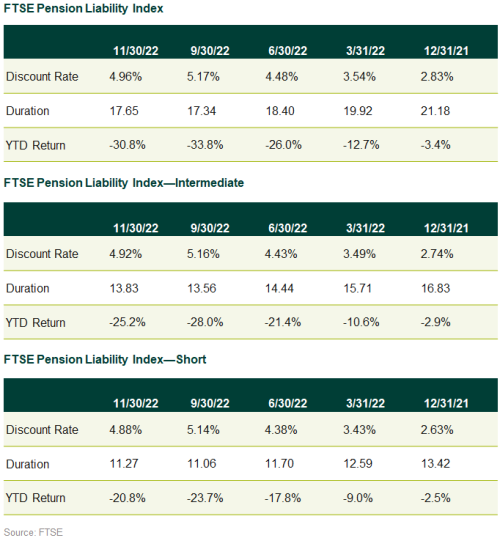

Pension Liability Index Detail

Discount rates, as of the end of November, are well inside those at the end of 3Q22. For plans that actively manage the hedge ratio, extending duration during 3Q and the first few weeks of 4Q has paid off as rates have fallen since the end of the quarter. Plans with shorter durations (i.e., those with more mature populations) have seen their liabilities contract by just over 20% YTD, while those with longer durations (e.g., open and accruing) have seen liabilities decrease by nearly a third YTD.

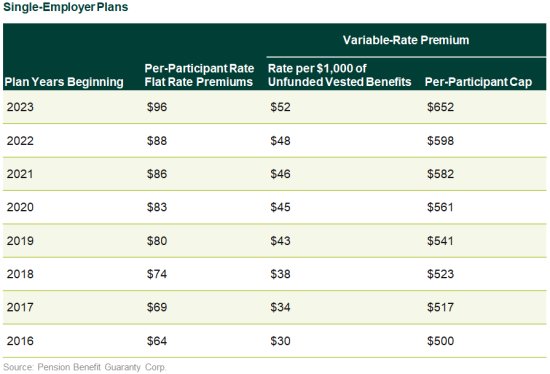

PBGC Premium Increase

The Pension Benefit Guaranty Corp. (PBGC) updated its flat-rate and variable-rate premiums for single- and multi-employer plans in 4Q22. Since the rates are indexed, it’s not surprising that they rose; however, you might be surprised by how much they increased (9% for 2023) and that they are indexed to changes in the national average wage index, rather than inflation.

Pension Risk Transfer Activity

This is already the largest year on record for pension risk transfer premiums written. With an estimated $27 billion that came to market in 3Q, many plan sponsors are asking the question as to when, why, and how to transfer all or a portion of their liabilities. IBM’s $16 billion transfer, covering 100,000 retirees and assumed by insurers MetLife and Prudential Financial, was announced in mid-September and reduced the company’s pension liabilities by approximately 40%. This transaction, while massive, ranks second to Prudential’s 2012 assumption of General Motors’ $25 billion group annuity contract. Additional large-scale activity during 3Q included Alcoa’s transfer of $1 billion in retiree pension obligations to Athene and Fidelity National Financial’s $620 million in buyout activity. It is estimated that 2022 will close out the year surpassing all prior annual periods at an estimated $55 billion in pension risk transfer activity. Some plan sponsors have experienced an increase in funded ratios and are evaluating if now is the time to settle certain liabilities. In many cases this is the result of being underhedged, from an interest rate perspective, during a period when discount rates have more than doubled. The dramatic increase in discount rates coupled with a 9% jump in both fixed-rate and variable-rate PBGC premiums make a healthy case for reducing in-pay liabilities.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.